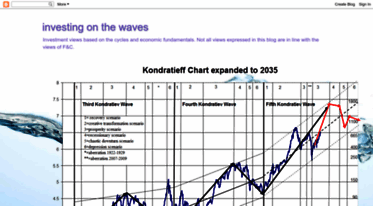

investing on the waves

Investing On The Waves Blogspot. Investment views based on the cycles and economic fundamentals..

Read Investingonthewaves.blogspot.com news digest here: view the latest Investing On The Waves Blogspot articles and content updates right away or get to their most visited pages. Investingonthewaves.blogspot.com is not yet rated by Alexa and its traffic estimate is unavailable. It seems that Investing On The Waves Blogspot content is notably popular in USA. We haven’t detected security issues or inappropriate content on Investingonthewaves.blogspot.com and thus you can safely use it. Investingonthewaves.blogspot.com is hosted with Google LLC (United States) and its basic language is English.

Content verdict: Safe

Content verdict: Safe

Website availability: Live

Website availability: Live Language: English

Language: English Last check:

Last check:

-

N/A

Visitors daily -

N/A

Pageviews daily -

N/A

Google PR -

N/A

Alexa rank

Best pages on Investingonthewaves.blogspot.com

-

investing on the waves: The Benner cycle

http://www.ritholtz.com/blog/2010/08/the-56-year-benner-cycle/ The 56 Year Benner Cycle “Periods When to Make Money” (© 1883) Yesterday, we looked at Long Term Market Cycles dating back to 1927; Today...

-

Investment views based on the cycles and economic fundamentals. Not all views expressed in this blog are in line with the views of F&C.

-

investing on the waves: asset economy versus balansrecessie

Ons boek heeft een zeer ongeloofwaardige stelling: de asset economy verhoogt de economische groei structureel met ongeveer 0,5 tot 1%. In he...

Investingonthewaves.blogspot.com news digest

-

12 years

Woody Brock: why economic growth will be lower, unintended consequenses of QE an...

Why growth in the world will not be as high as in the past

It is not necessary for economic growth to be so low in the coming years, but there are several factors why growth will be lower in the coming years than in the last decades.

In the -

12 years

four year cycle: have we seen the top?

Ter Veer and I always judged in which phase we were in the cycle. The current cycle is lasting too long as happens often when you have had a very severe downturn with a long and this time slow recovery.

The prices of the S&P are compared with (red line) what the fundamental value seems to be: 14 times trailing earnings corrected for the cycle (with ISM/50). This shows the S&P went up about 200 points too much probably because of QE.... -

13 years

S&P to go to 1620-1650 in 2013

Business Insider had some nice slides where several gurus showed their chart of the year. The above of Matt King shows how the S&P500 marched up with the balance sheet of the FED. A $1000 billion QE was enough to get the S&P500 320 points higher...

-

13 years

The intention is to give forecasts for possible trends that are underestimated by the market according to us.

1. After a weak H1 US economic growth will surprise to the upside (3%+). 3.5-4% growth in 2014 very well possible.

2. According to expected QE and the president cycle of the last three decades the S&P500 should rise to 1620-1650. This could very well be the case even while the market will be more volatile than in 2012 with the possibility of a nasty shock that...

Domain history

| Web host: | Google LLC |

| Registrar: | MarkMonitor Inc. |

| Registrant: | Google LLC |

| Updated: | June 29, 2025 |

| Expires: | July 31, 2026 |

| Created: | July 31, 2000 |

Whois record

Safety scores

Trustworthiness

N/AChild safety

N/A